TCHFH Lending, Inc.

Twin Cities Habitat for Humanity’s nonprofit mortgage subsidiary, TCHFH Lending, Inc. offers the TruePath Mortgage product to low-and-moderate income households across the seven-county metro. TruePath Mortgage can be used on a Habitat-built home or a home you find on the open market. Own a home you love with a mortgage you can afford. Together, we are creating more opportunities for successful homeownership.

Discover what TruePath Mortgage is all about

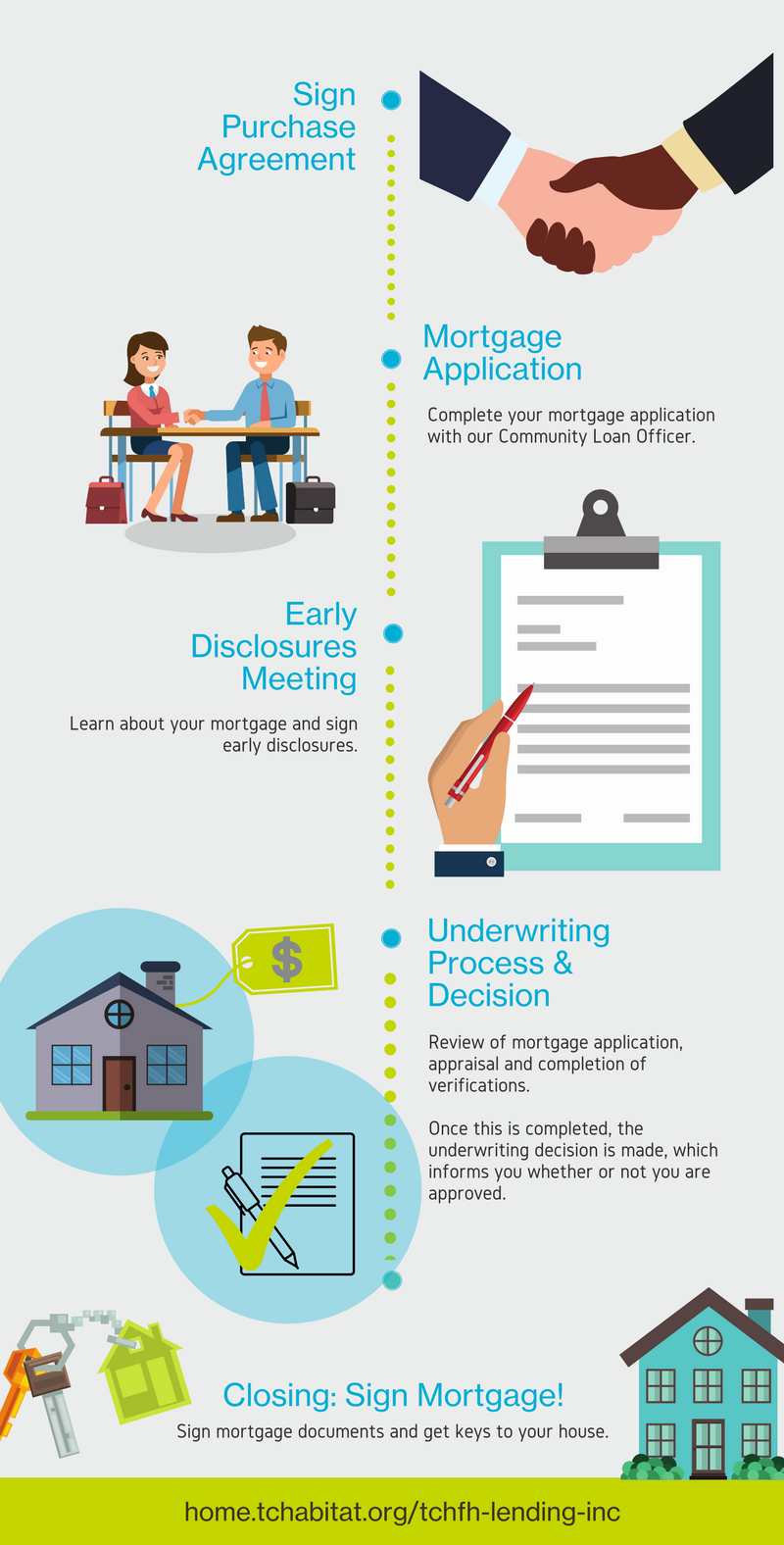

The Mortgage Product and Process

TruePath Mortgage Product

-

5.25% fixed interest rate, 5.3059% APR

-

30-year term

-

Affordable monthly housing payment set at no more than 30% of gross income

-

No mortgage insurance

-

Maximum mortgage of 96.5% of home’s value – down payment and affordability assistance available depending on income qualification and availability.

-

Borrower contribution of $3,000 towards closings costs (not including owner’s title insurance if the homebuyer chooses to purchase)

Application Requirements

-

Complete Twin Cities Habitat for Humanity’s Homeownership Program

-

Meet our income eligibility guidelines

-

Be a first-time Homebuyer (haven’t owned property in the past three years)

-

Currently live in the 7-county metro area

-

Purchase a primary residence

Underwriting Requirements for Approval

-

Preferred credit score of 620 – Credit scores between 580-620 or invisible/no credit acceptable with alternative credit documentation

-

$6,300 in savings

-

Total monthly debt payments no more than 13% of gross monthly income

-

No outstanding liens or judgments

-

Six months at current job with two years of continuous employment history for full-time jobs. Two years at current position for part-time and self-employed workers.

-

Minimum of two years since bankruptcy, with 24 months of re-established credit

-

Minimum of three years since foreclosure or short sale

-

Maximum of $1,000 in outstanding collections (medical collections do not impact eligibility)

Fernanda De La Torre

Down Payment Assistance Program Manager

Bay Yang

Loss Mitigation Specialist

.jpeg?width=700&height=392&name=Brooke%20Buchanan%20(3).jpeg)

Brooke Buchanan

Mortgage Servicing Coordinator

.jpeg)

Dao Cheng

Lead Mortgage Processor

Pang Vang

Down Payment Assistance Program Coordinator

Jessica Smith

Mortgage Processor

Latasha Marriott

Mortgage Processor

Robyn Bipes-Timm

Chief Strategy and Operations Officer

President, TCHFH Lending Inc.

NMLS 1486469

Robyn Bipes-Timm, as Chief Strategy and Operations Officer, leads Habitat’s strategic plans and special initiatives and aligns strategy with effective operations in finance, lending, people and culture, technology, and retail. She is President of Habitat’s nonprofit CDFI, TCHFH Lending, Inc. Prior to Habitat, Robyn led statewide affordable rental and homeownership programs, financing, and lending at other CDFIs. Robyn is passionate about affordable housing and creative ways to bring equitable access to communities. She has a master’s degree in public policy from the Humphrey School, is a CDFI graduate of the Wharton School of Business, and holds MN mortgage originator and realtor licenses. She is on several boards and national housing groups, is co-creator of the Minnesota CDFI Coalition, and is outdoors whenever possible with her husband Jeff, young daughter Luci, and dog Tipsy.

Betsy Mills

VP of Finance and Lending

NMLS 847727

Betsy is the Vice President of Finance and Lending for Twin Cities Habitat for Humanity. In this role she oversees finance ensuring long-term financial sustainability for the organization and its subsidiaries. As Secretary of TCHFH Lending, Inc., she leads the lending team responsible for supporting low- and moderate-income homebuyers and homeowners to access and sustain their mortgages. Prior to joining in 2013, she worked in the banking industry. Betsy holds a BA in Accounting and Business Administration from Concordia College in Moorhead and her MN Mortgage Originators licensure. Outside of work she spends her time with her husband and three daughters.

Bethany Nagan

Director of Lending

NMLS 1676395

Bethany has been with Twin Cities Habitat since March of 2017 and brings five years of mortgage industry experience. Bethany manages the portfolios of mortgages for Twin Cities Habitat for Humanity and TCHFH Lending, Inc. after origination through the life of the loan. She works directly with homeowners regarding their mortgage for any issues or needs that arise. Bethany received her BS in International Economics and BA in Finance and French Language Studies from the University of St. Thomas. When not working, Bethany enjoys sunshine, water, and traveling the world.

Maureen Holman

Mortgage Origination Manager

NMLS 400794

Maureen engages with all homebuyers for mortgage application through closing, informing them of our affordable first mortgage product. Prior to joining TCHFH Lending Inc. in the fall of 2016, Maureen worked for several mortgage lenders in the Twin Cities metro area over her 30-year history of working in the mortgage industry. She holds a BA in Communications from the University of Minnesota and her MN Mortgage Originators license. She lives in White Bear Lake with her husband, and has three adult children who attend college.

Jen LaCroix

Community Lending Manager

NMLS 175499

Jen started with Habitat in January 2018 and brings 20+ years of lending experience. Prior to joining TCHFH Lending Inc., Jen worked with local lenders in Minnesota specializing in renovation and reverse financing. She enjoys helping first-time homebuyers make their dream of homeownership a reality. Jen leads the Realtor outreach team, working with local Realtors and community groups to educate and support their efforts to help more first-time homebuyers. Jen lives in Apple Valley with her husband and two daughters and travels often to visit her son who serves proudly in the US Air Force.

Fernanda De La Torre

Down Payment Assistance Program Manager

Fernanda De La Torre is the Down Payment Assistance Program Manager with TCHFH Lending, Inc. In her role, she works closely with local CDFIs and lenders and focuses on creating effective and efficient processes for the DPA programs. Her background lies in evaluation research, program management, and refugee resettlement. Fernanda received her undergraduate degree in International & Environmental studies from UW-Madison and her master's degree in Social Policy from Brandeis University. When not working, Fernanda enjoys spending her time traveling, being with family/friends, cooking or trying new foods, and staying active outside.

Bay Yang

Loss Mitigation Specialist

Bay (Amphone) has been with TCHFH Lending, Inc. as the Loss Mitigation Specialist since October 2023. Bay has a background in mortgages as a loss mitigation, origination, compliance, and quality assurance. Bay’s primary responsibility of the Loss Mitigation Specialist is to support and work with homeowners who are experiencing hardship with their mortgage. She enjoys international travel, cuisine, and culture in addition to trying out new recipes.

Brooke Buchanan

Mortgage Servicing Coordinator

Brooke has been with TCHFH Lending, Inc. as the Mortgage Servicing Coordinator since December 2021. Brooke has a background in nonprofits as a Program Administrator, in mortgage as a Loan Processor, and in construction as an Estimating Assistant. Brooke provides support to TCHFH Lending, Inc.’s Mortgage Portfolio Manager and is the first point of contact for homeowners who need help in navigating their mortgage. She enjoys working with the community and in mortgage, and is happy to have found a team that does both. When not working, Brooke enjoys baking, traveling, and spending time with her family.

Dao Cheng

Lead Mortgage Processor

Dao works with homebuyers to process the necessary documentation for closing and other steps in the homebuying journey. Dao graduated from St. Catherine’s University with a B.S. in Mathematics and has an interest in Asian history and culture. Dao is going back to school in Fall 2018 for a Master’s in Data Science. She has taught in South Korea and at Hopkins Junior High and previously worked at Wells Fargo and Bell Bank.

Steven Stinson

Community Loan Officer

NMLS 2190361

Steven is a Loan Officer with TCHFH Lending, Inc. and helps manage relationships with Agents/Brokers through our Realtor Connect social networks. He brings with him a unique set of skills and a passion for building equitable communities. He joins the team from Wells Fargo, where he was a Home Mortgage Consultant helping families from all walks of life purchase or refinance their homes. Steven has been a small business owner, worked in local politics doing outreach, and has managed a city council campaign for Ward 3 in Minneapolis. Through his many endeavors there is one thing at the center of everything he’s done, and that’s community. Steven is looking forward to building relationships with potential homebuyers and partnering with Realtors to help families reach their dreams of home ownership.

Zachary Blake

Down Payment Assistance Loan Originator

NMLS 1428418

Zach is a seasoned mortgage professional with over 12 years of experience in the industry and has done everything from origination to post closing. He has navigated through roles in both small and large institutions, honing his skills and expertise along the way. He thrives at finding solutions, efficiencies, and has a deep understand behind the "why" in each step of the mortgage process. When not immersed in the world of mortgage, you can spot Zachary at local concerts or unwinding at his favorite spots in the North Loop. He’s also an avid cook and baker who enjoys whipping up meals and treats for his loved ones. As a DPA Originator, Zachary looks forward to partnering with and educating potential homebuyers so they can achieve their dreams of homeownership.

Pang has more than 10 years of experience in the mortgage industry, with seven of those years focused on quality control. Pang enjoys working to ensure accuracy, compliance, and operational excellence in mortgage processes. Currently, Pang serves as the Down Payment Assistance Program Coordinator, helping individuals and families access homeownership opportunities through tailored assistance programs. Pang is passionate about making the path to homeownership clearer and more attainable within the community.

Other Helpful Links & Resources

View Habitat Homes For Sale

View our current home listings. These listings are updated each month to show newly-added properties and homes that have sold.

We can help you with the mortgage process

Each family that applies for a mortgage with TCHFH Lending, Inc. must meet application and underwriting requirements for approval. If you don't meet these requirements today, that's okay! Twin Cities Habitat's financial advisors can help you get there.

Questions about our mortgage product?

Sample Mortgage Terms

The terms below are not specific to these properties. They are intended to provide an example of terms for a mortgage at $240,000. Individual mortgages are based on borrower income.

| Estimated First Mortgage | $240,000 |

| Fixed Interest Rate | 5.25% |

| APR (Annual Percentage Rate) | 5.3059% |

| Monthly Principal and Interest Payment *Monthly payment estimates quoted reflect the principal and interest portion of the payment and do not include homeowner’s insurance or property taxes, which are also required to be paid. |

$1,325.29 |

| Term | 30 Years |

| Borrower Down Payment | $0.00 |

| Borrower-Paid Closing Costs *Borrower’s contribution to closing costs does not include the owner’s title insurance policy if the homebuyer chooses to purchase. |

$3,000 |

| Please note that our rates and terms can change at any time. | |

We’re proud to support Equal Opportunities for All.

.jpeg)

.jpeg)